Tag Archives: life insurance

Celebrating Christmas With a Financial Gift of Love

Christmas is a time when you can express your love and care through thoughtful gifts. While traditional presents bring joy, consider a gift that provides lasting security and peace of […]

New! Simplified Issue Whole Life Insurance

No Wait, No Worries. Say goodbye to a lengthy process. We believe in making life insurance accessible without unnecessary hurdles, ensuring your coverage is in place swiftly. Up to $100,000 […]

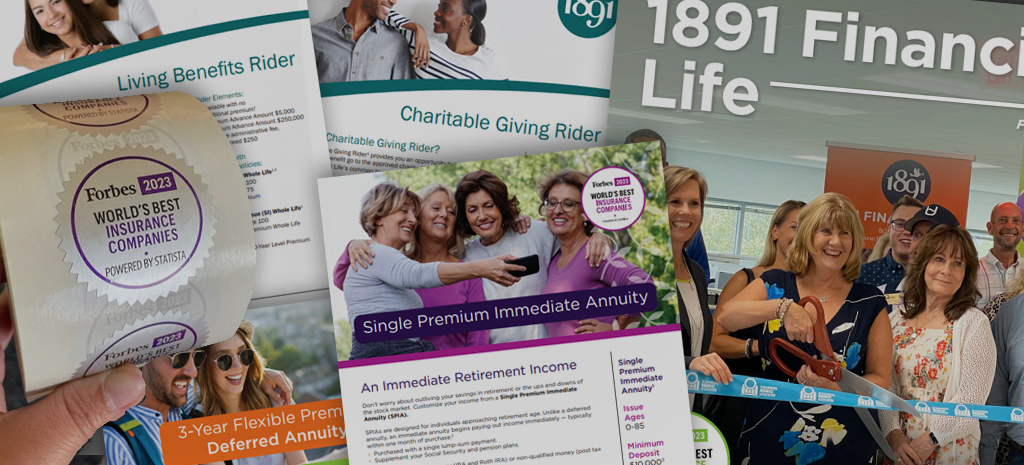

2023 Recap & 2024 Dreams: 1891 Financial Life’s Journey

As we bid farewell to 2023 and welcome the promises of a new year, we at 1891 Financial Life are filled with gratitude and excitement as we reflect on the […]

Why Most American Adults Lack Adequate Life Insurance

Life insurance is a crucial part of thoughtful financial planning. It offers financial support for your end-of-life expenses, helps settle debts, and ensures your family’s well-being. However, a significant number […]

Unlocking Financial Security: The Power of Living Benefits Riders

Life insurance offers a financial safety net for loved ones, helping to provide for your family even after you’re gone. Yet, the power of life insurance extends beyond the final […]

Giving Back in 2024

When you hear the word “philanthropy,” you may think of wealthy individuals giving millions to a cause. However, anyone can be a philanthropist by giving to a charitable organization, even […]

Motherhood and Financial Security: The Role of Life Insurance

As a mom, you juggle a lot — ensuring your children have a roof over their heads, food on the table, school supplies, and plenty of TLC. It’s a tough […]

Life Insurance 101: A Glossary of Terms

Most people know they need life insurance, but some put off shopping for a policy because they feel overwhelmed by insurance jargon. Learning what insurance terminology means can make you […]

Understanding Whole Life Insurance

One fundamental aspect of financial planning is understanding the nuances of life insurance policies. Whereas term life insurance provides coverage over a specific period, whole life insurance is a permanent […]

Benefits & Considerations of Borrowing Against Your Whole Life Insurance Policy

Life insurance provides a valuable sense of security and peace of mind for policyholders and their families. One facet that you should understand is the ability to borrow against your […]

Securing the Future: How to Designate a Charity as Your Life Insurance Beneficiary

Selecting a beneficiary for a life insurance policy is a vital decision that reflects an individual’s desire to plan for the financial well-being of their loved ones or the causes […]

The Affordable Gift of Life Insurance

When we think of presents during Christmas-time we usually think of toys, books, or cash for the children in our family. However, one of the best gifts that we can give […]

What Is the Role of Life Insurance in Estate Planning?

An estate plan aims to organize, manage, and distribute your assets according to your wishes. You can also use the planning process to minimize the financial burden on your loved […]

Do I Need Life Insurance If I Have a 401(k)?

In the realm of long-term financial planning, individuals often face the question: “Do I Need Life Insurance If I Have a 401(k)?” Contrary to common misconceptions, the answer lies not […]

How Life Insurance and Annuities Work Together for Your Retirement

Two powerful tools for securing your retirement and protecting your family are life insurance and annuities. Individually, they serve distinct purposes, but when strategically combined, they can create a formidable […]

6 Life Insurance Myths Debunked: Separating Fact From Fiction

Some of the most common misunderstandings about life insurance coverage can prevent individuals from making informed decisions about their financial security. In this blog post, we reveal prevalent myths surrounding […]

Life Insurance for Single Individuals: Planning for the Unpredictable

Life policies can provide a financial safety net for married individuals with dependents, but the importance of life insurance extends beyond traditional family structures. Singles, too, can benefit significantly from […]

Life Insurance for Millennials: Why It’s Essential for Your Financial Wellness

The millennial generation has transitioned from the uncertainties of early adulthood to career and family responsibilities. As this generation progresses into their 30s and 40s, achieving financial stability becomes paramount. One […]